About the Candidate

Vancity is a member-owned, community-based, full-service financial institution whose primary activities include retail and business banking (deposit-taking and lending), commercial mortgage lending, and investment advice and services. Vancity also operates foreign exchange, life insurance, Visa credit cards, real estate development and investment advisory services through wholly-owned subsidiaries.

Vancity是一家会员所有、以社区为基础的全方位服务金融机构,其主要业务包括零售和商业银行业务(存款和贷款)、商业抵押贷款以及投资建议和服务。 Vancity还通过全资子公司经营外汇、人寿保险、Visa信用卡、房地产开发和投资咨询服务。

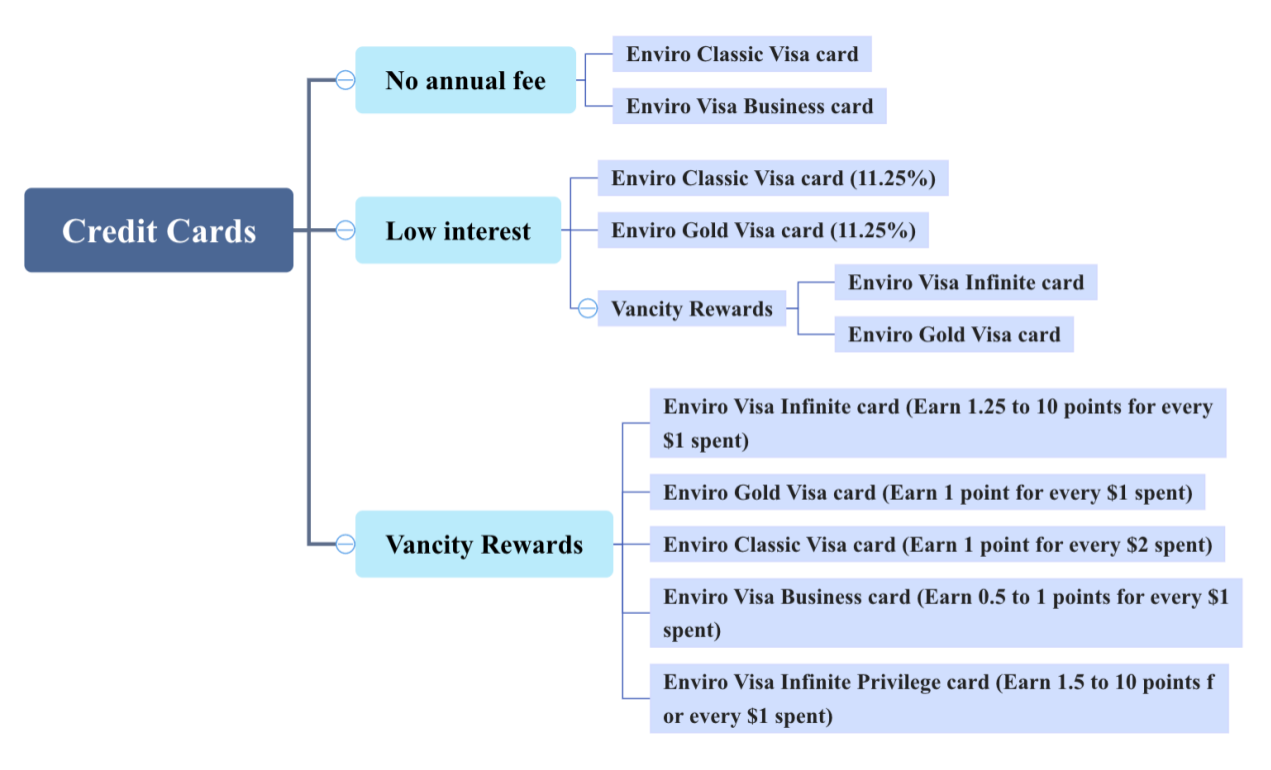

Credit Cards

Mortgages

l Business Mortgages

Businesses can purchase or refinance property and arrange construction financing for owner-occupied or revenue-generating business properties up to $10 million.

抵押贷款业务

l 企业可以购买或再融资财产,并为自住或创收的商业财产安排建设融资,最高可达1000万加元。

l Commercial Mortgages

Real Estate Investment mortgages

Real estate operators and developers can get fixed-rate or interim construction financing on multi-tenant real estate projects over $10 million.

房地产运营商和开发商可以获得超过1000万加元的多租户房地产项目的固定利率或临时建设融资。

Work with real estate operators and developers in selected metropolitan centres across BC. Community and investment mortgages are available for:

- Office, industrial and retail properties

- Land acquisitions

- Industrial, commercial and investment property developments

- Multi-family residential properties e.g. condominiums and town homes

与不列颠哥伦比亚省选定大都市中心的房地产运营商和开发商合作。社区和投资抵押贷款可用于:

• 办公、工业和零售物业

• 土地收购

• 工业、商业和投资房地产开发

• 多户住宅物业,例如 公寓和联排别墅

Investment

1. Tax-Free Savings Account (TFSA)

2. Term deposits / GICs

3. Registered Retirement Savings Plan (RRSP)

4. Registered Education Savings Plan (RESP)

5. Registered Retirement Income Fund (RRIF)

6. Registered Disability Savings Plan (RDSP)

投资

1.免税储蓄账户(TFSA)

2.定期存款/担保投资证

3.注册退休储蓄计划(RRSP)

4.注册教育储蓄计划(RESP)

5.注册退休收入基金(RRIF)

6.注册残障储蓄计划(RDSP)

Pros and Cons List:

Pros:

1. Vancity offers a wide range of financial products to its members. All banking needs are met through this single financial institution.

2. Profit-sharing with community. Today, 30% of its net profits go back to communities across Canada.

Cons:

1. Vancity has lower interest rates compared to other credit unions and online banking.

2. Annual fees on credit cards are on the high side.

优点和缺点列表:

——优点:

1.Vancity为其会员提供广泛的金融产品。通过这家单一的金融机构满足所有银行业务需求。

2.与社区共享利润。如今,其30%的净利润回馈给加拿大各地的社区。

——缺点:

1.与其他信用合作社和网上银行相比,Vancity的利率较低。

2.信用卡年费偏高。