About the Candidate

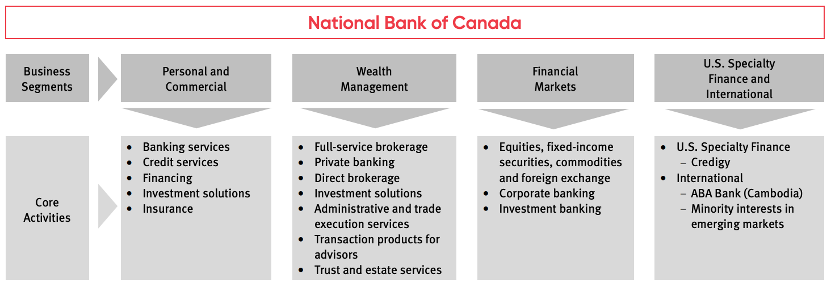

National Bank of Canada offers a complete range of financial products and services to retail, commercial and corporate clients. Active in the international market, engaged in securities brokerage, wealth management, insurance, investment trusts and retirement solutions. It operates in Canada through three business segments: Personal and Commercial Banking, Wealth Management and Financial Markets. A fourth segment— U.S. Specialty Finance and International—complements the growth of the domestic operations.

加拿大国家银行为零售、商业和企业客户提供一系列完整的金融产品和服务。活跃于国际市场,从事证券经纪、财富管理、保险、投资信托和退休解决方案。它在加拿大通过三个业务部门开展业务:个人和商业银行业务、财富管理业务和金融市场业务。第四个部门——美国专业金融和国际业务——补充了国内业务的增长。

Total Revenues of the Four Business Segments in 2021 2021年四大业务板块的总收入

Core Activities of the Four Business Segments四大业务部门的核心活动

Personal and Commercial Banking个人及商业银行业务

Personal Banking:

Personal Banking offers a complete range of financial and investment products and services to help customers achieve their financial goals at every stage of their lives. It offers everyday transaction solutions, mortgage and home equity lines of credit, consumer loans, payment solutions, savings and investment solutions, and a range of insurance products.

个人银行:

个人银行为客户提供全方位的理财和投资产品及服务,帮助客户实现人生各个阶段的理财目标。它提供日常交易解决方案,抵押贷款和房屋净值信贷额度,消费贷款,支付解决方案,储蓄和投资解决方案,以及一系列保险产品。

Commercial Banking:

Commercial Banking serves the financial needs of SMEs and large corporations to help them grow. It offers a full range of financial products and services including credit, deposits, investment solutions, international trade, foreign exchange transactions, payroll, cash management, insurance, electronic transactions and ancillary services. Commercial Banking is the leading provider (in Quebec) of core banking products for businesses and is known across Canada for its expertise in specific industries such as health care, agriculture and agri-food, technology, creative industries, real estate and energy.

商业银行:

商业银行服务于中小企业和大企业的金融需求,帮助它们成长。它提供全方位的金融产品和服务,包括信贷、存款、投资解决方案、国际贸易、外汇交易、工资、现金管理、保险、电子交易和辅助服务。商业银行是(魁北克省)为企业提供核心银行产品的领先提供商,并以其在特定行业(如医疗保健、农业和农业食品、技术、创意产业、房地产和能源)的专业知识在加拿大各地闻名。

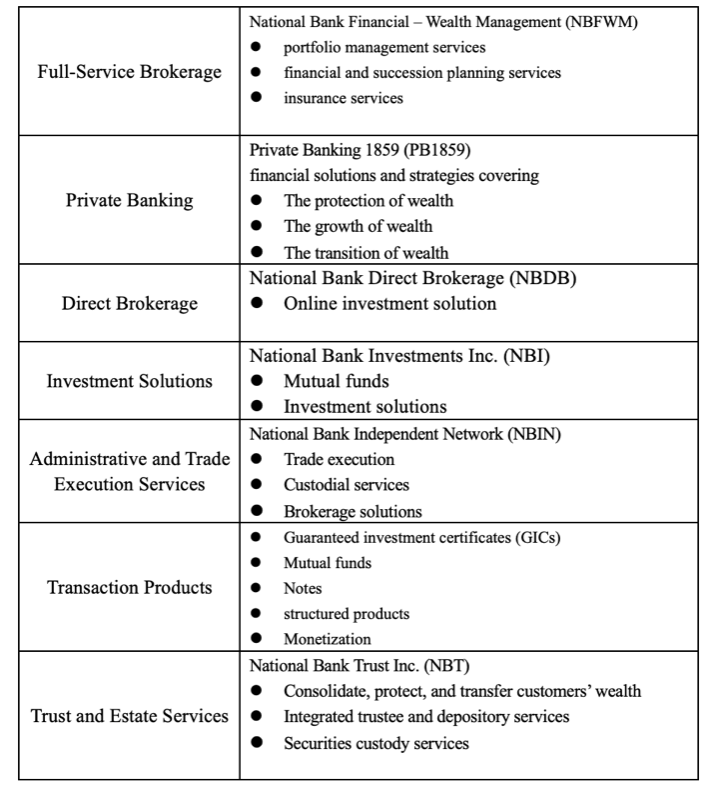

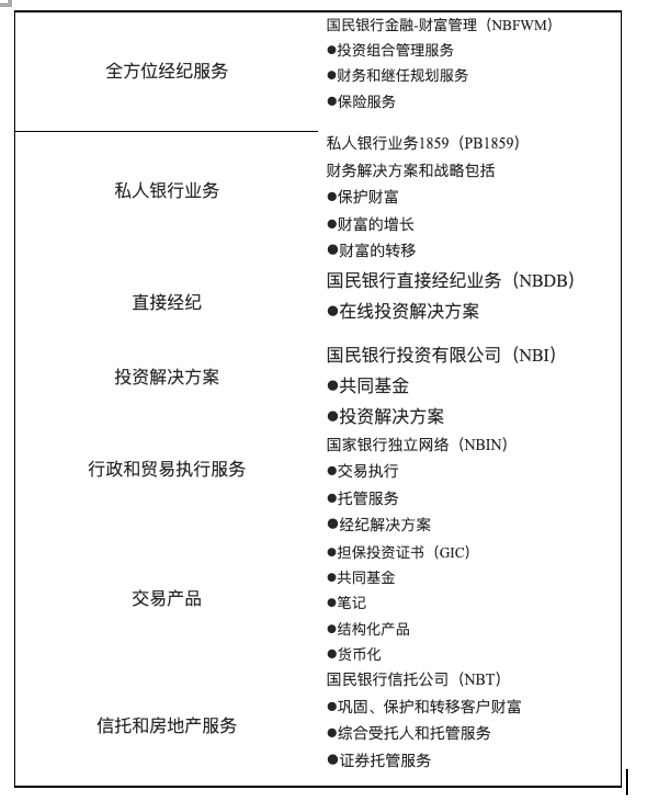

Wealth Management

The Wealth Management segment serves all market segments with an emphasis on advisory services and close client relationships. Through a multi-channel distribution network and a differentiated business model, the segment provides customers with a full range of financial products and solutions. It also provides services to independent advisors and institutional clients.

财富管理业务

财富管理部门服务于所有细分市场,重点是咨询服务和密切的客户关系。通过多渠道的分销网络和差异化的业务模式,为客户提供全方位的金融产品和解决方案。它还为独立顾问和机构客户提供服务。

Business Units:

Financial Markets

Global Markets:

Financial Markets is both the leader in risk management solutions and structured products and the largest market maker of exchange traded funds (etf) in Canada. The segment provides solutions across fixed income securities, currencies, equities and commodities to mitigate clients’ financial and business risks. It also provides new product development expertise to asset managers and fund companies. All asset classes in the institutional and retail distribution channels will be offered tailored investment products.

全球市场:

金融市场是加拿大风险管理解决方案和结构性产品的领导者,也是加拿大最大的交易所交易基金的做市商。该部门提供固定收益证券、货币、股票和大宗商品的解决方案,以减轻客户的金融和业务风险。它还为资产管理公司和基金公司提供新产品开发专业知识。机构和散户分销渠道的所有资产类别都将提供量身定制的投资产品。

Corporate and Investment Banking:

Financial Markets offers corporate banking, advisory and capital markets services. The segment is both a leader in investment banking and in underwriting Canadian government debt and corporate high-yield debt. Its comprehensive services include strategic advice on financing and mergers and acquisitions, as well as debt and equity underwriting. Financial markets is active in securitized financing, primarily mortgages and mortgage-backed securities guaranteed by the Canadian government.

企业及投资银行业务:

金融市场提供企业银行、咨询和资本市场服务。该部门在投资银行业务以及加拿大政府债券和企业高收益债券承销方面都处于领先地位。其综合服务包括融资和并购的战略建议,以及债务和股票承销。金融市场活跃于证券化融资,主要是由加拿大政府担保的抵押贷款和抵押贷款支持证券

Pros and Cons List:

Pros:

1. Earn high savings interest

2. Canadian and US dollar accounts

3. Lots of credit card options

4. Plenty of mortgage options

Cons:

1. Wire transfers through NBC will have to face high transfer fees. There is no flat rate for transfer fees, but they vary depending on the country/region to which you send the money.

2. Transfer only if you have an account.

利弊清单:

——优点:

1. 赚取高额储蓄利息

2. 加拿大和加元账户

3. 有很多信用卡可供选择

4. 大量的抵押贷款选择

——缺点:

1. 通过NBC电汇将面临高额转会费。转会费没有统一的费率,但根据你汇款的国家/地区的不同而有所不同。

2. 只有有账户的人才可以转账。