About the Candidate

Personal & Business Banking:

- Personal Banking: Scotiabank’s personal banking provides day-to-day banking products and services to its clients, including personal banking accounts, credit cards, investments, mortgages, loans and related creditor insurance to its customers.

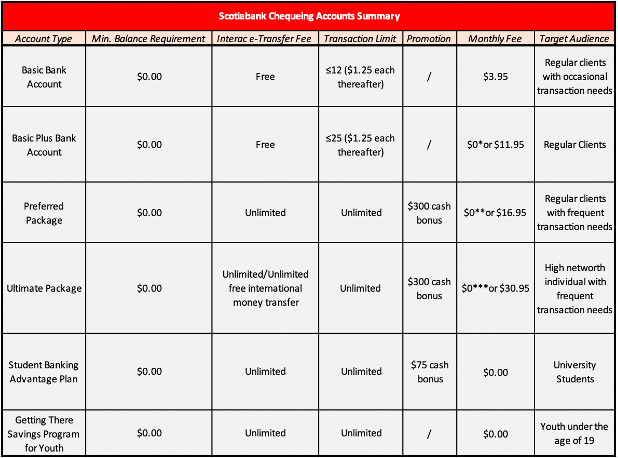

o Six Types of Chequing Accounts

个人和商业银行业务:

- 个人银行业务:丰业银行的个人银行业务向客户提供日常银行产品和服务,包括个人银行账户、信用卡、投资、房贷、贷款和相关债权人保险。

o 六种支票账户:

* No monthly account fee by maintaining a minimum daily closing balance of $3,000 for the entire month

** No monthly account fee by maintaining a minimum daily closing balance of $4,000 for the entire month

*** No monthly account fee by maintaining a minimum daily closing balance of $5,000 in your Ultimate Package, or a combined balance of $30,000 across your Ultimate Package and your Momentum Plus Savings Account

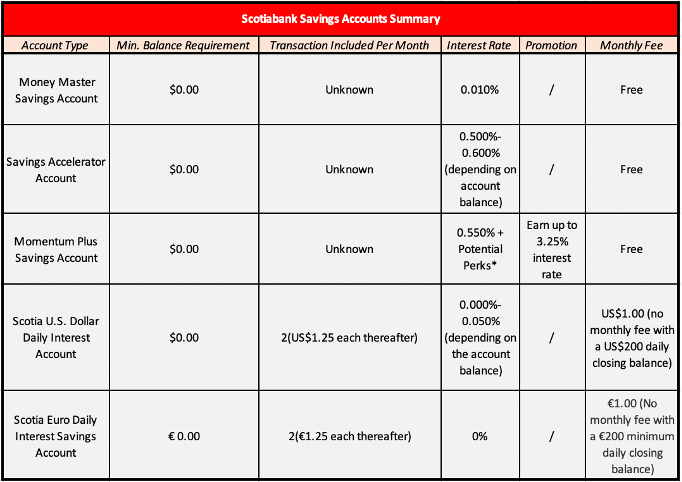

o Five Types of Savings Accounts

五种储蓄账户

* Extra interest up to 2.7% could be applied for a limited time

o Credit Cards

Scotiabank provides a good collection of credit cards that offer the perks of travel & lifestyle, cash back, scene + points, no annual fee, or low interest rates. The interest rates on purchases range from 9.99% to 20.99%, while the interest rates on cash advances range from 9.99% to 22.99%. Different cards have different perks and disadvantages. For example, for travel lovers who are looking for low interest rates, they might consider the Scotiabank Platinum American Express Card. Its interest rates on purchases and cash advances are the lowest of all Scotiabank credit cards, both at 9.99%; cardholders are also eligible to earn 2x Scene points on every $1 spent on eligible purchases. However, it also has an expensive annual fee of $399, the highest of all the cards.

o 信用卡

Scotiabank 为其客户提供一系列信用卡,其中包含了旅行和生活方式、现金返还、Scene + 积分、无年费或低利率等福利。 这些卡的购买利率从 9.99% 至 20.99%不等,预支现金利率为 9.99% 至 22.99%不等。 不同的卡有不同的优缺点。 例如,对于寻求低利率信用卡的旅行爱好者,他们可能会考虑丰业银行白金美国运通卡。 其购买和预支现金的利率是所有丰业银行信用卡中最低的,均为 9.99%; 持卡人在符合条件的购买上每消费 1 美元还有资格获取2倍 Scene +积分。 但是,它也有昂贵的 399 美元的年费,是所有信用卡中最高的。

o Overdraft protection

Scotiabank also offers overdraft protection to prepare for unexpected expenses. Based on their preference, clients can either choose the Monthly Overdraft Protection Plan at a cost of $5/month, or the Pay-Per-Use Overdraft Protection Plan for $5/use. Ultimate Package users are eligible to enjoy overdraft protection for free.

o 透支保护

丰业银行还提供透支保护,为意外开支做准备。 根据自己的喜好,客户可以选择每月$5的透支保障计划,或$5/次的按次付费付费透支保障计划。 Ultimate Package 用户有资格免费享受这项权利。

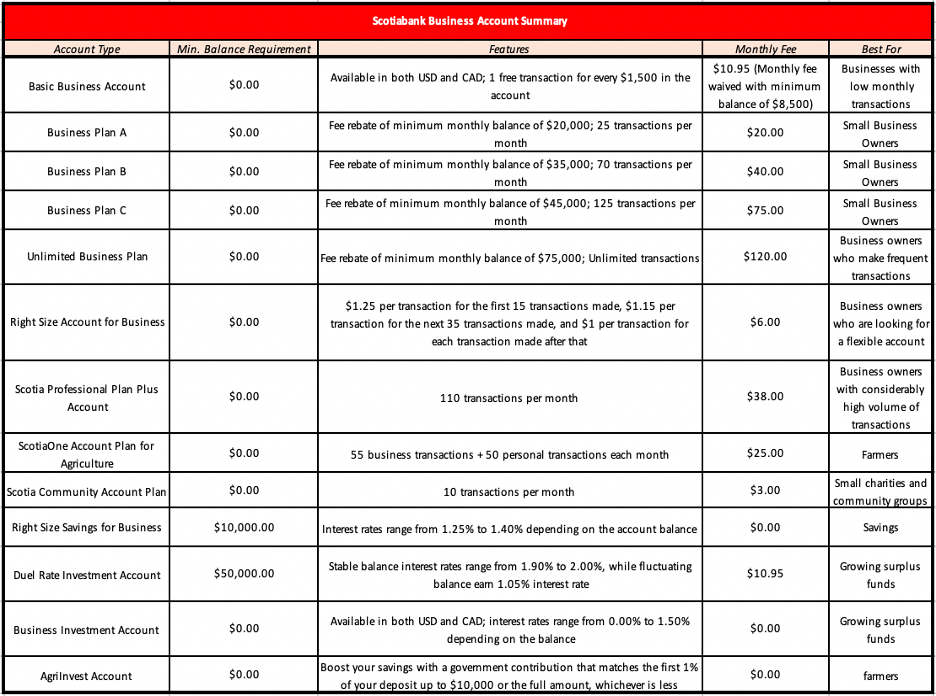

- Business Banking: Scotiabank’s business banking section provides a selection of products and services including lending, deposit, cash management as well as providing financial solutions to small, medium, and large businesses.

Below is a list of business banking accounts that Scotiabank offers:

- 商业银行业务:丰业银行的商业银行业务部门提供一系列产品和服务,包括贷款、存款、现金管理以及为小型、中型和大型企业提供解决方案。

以下是丰业银行提供的商业银行账户列表:

Wealth Management:

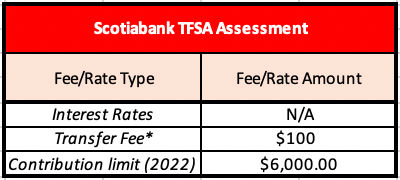

- Tax-Free Savings Account (TFSA): Scotiabank’s TFSA is a type of registered investment account that enables clients to invest in products such as GICs and portfolio solutions while offering them tax advantages. Below is the general assessment of Scotiabank’s TFSA:

- 免税储蓄账户 (TFSA):丰业银行的 TFSA 是一种注册投资账户,使客户能够投资于 GIC 和投资组合解决方案等产品,同时为他们提供税收优惠。 以下是对丰业银行 TFSA 的总体评估:

- Guaranteed Investment Certificate (GICs): Like most commercial banks, Scotiabank offers various types of GIC products such as long-term/short-term non-redeemable GICs, personal redeemable GICs, cashable GICs, and equity linked GICs.

- GIC (担保投资证明): 与大多数商业银行一样,丰业银行提供各种类型的 GIC 产品,例如长期/短期不可赎回 GIC、个人可赎回 GIC、可兑现 GIC 和股票挂钩 GIC。

- Portfolio Solutions: Scotiabank primarily provides five types of portfolio solutions to suit different investors’ needs including Scotia Aria Retirement Portfolios, Scotia Selected Portfolios, Scotia INNOVA Portfolios, Scotia Partners Portfolios, and DynamicEdge Portfolios. It is worth mentioning that the Scotia Aria Retirement Portfolios is an unique investment option because it allows clients at different stage in life to build their portfolios and grow their savings to prepare for retirement, whether it is in 10 years or 40 years.

- 投资组合解决方案:丰业银行主要提供五种类型的投资组合解决方案,以满足不同投资者的需求,包括 Scotia Aria Retirement Portfolios、Scotia Selected Portfolios、Scotia INNOVA Portfolios、Scotia Partners Portfolios 和 DynamicEdge Portfolios。 值得一提的是,Scotia Aria Retirement Portfolios 是一种独特的投资选择,因为它允许处于人生不同阶段的客户建立自己的投资组合并增加储蓄,为退休做准备,无论他们的退休时间是 10 年后还是 40 年后。

Pros:

- More flexibility in personal banking options

- Overdraft protection program

- Scotia Aria Retirement program is the only retirement program of its kind in Canada.

优点:

- 个人银行选项更加灵活

- 透支保障计划

- Scotia Aria 退休计划是加拿大唯一的此类退休计划。

Cons:

- Lack of USD business account

- Relatively low return rates on most GICs and most of them are non-redeemable

- Customer service isn’t the greatest according to several online rating platforms

- Does not offer mandarin service for online banking

缺点:

- 美元商业账户较少

- 大多数担保投资证明的回报率相对较低,而且其中大部分是不可赎回的

- 根据几个在线评分平台的反馈来看,丰业银行的客户服务并不是最好的

网上银行不提供中文服务

Official Website:http://www.scotiabank.com

官方网站:http://www.scotiabank.com