About the Candidate

Competitive Advantages:

As an industry leader in Canada, RBC is ranked as #1 or #2 in market share in all key product categories, including personal lending, personal core deposits and GICs, credit cards, long-term mutual funds, business loans ($0m-$25m), and business deposits, according to the company’s 2022 Q2 report.

竞争优势:

根据该公司2022年第二季度报告,作为加拿大的行业领导者,RBC在所有关键产品类别中的市场份额都排名第一或第二,包括个人贷款、个人核心存款和GIC(担保投资证明)、信用卡、长期共同基金、商业贷款(0万-2500万美元)和商业存款。

Personal & Commercial Banking:

Personal Accounts: Personal Banking is accounted for 73% of RBC’s personal and commercial banking’s total revenue by the end of the fiscal year 2021 (RBC 2021 annual report). Like most commercial banks, RBC offers both Chequing and Savings Account.

个人业务

从2021年的财务报告来看,该财年末,该行的个人银行业务占RBC个人和商业银行业务总收入的73%(RBC 2021年年度报告)。从对个人业务模块来看,该银行为客户提供支票账户、储蓄账户、以及信用卡账户等服务。加拿大的个人账户分成支票账户和储蓄账户。支票账户用于日常的开支支付也就是大家所理解的活期账户。而储蓄账户的主要功能是主要为客户提供不同投资期限的银行存款业务。

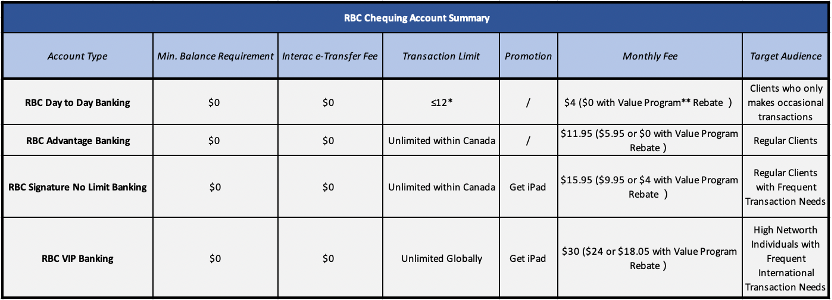

o Four Types of Chequing Account

*Limited to 12 transactions per month, $1.25 each thereafter.

**Refers to the use of TD products including credit cards, mortgage, person investments, and small business accounts.

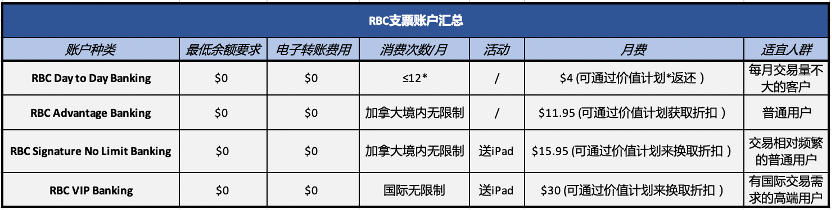

o 支票账户

RBC的支票账户有四种不同的类型:

*消费次数超出十二次的部分每笔消费将收取$1.25手续费

**指对信用卡,房贷,个人理财,及小企业账号等产品的使用

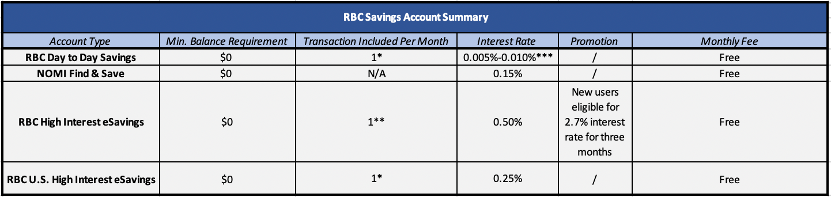

o Four Types of Savings Account

* One monthly debit is included; excess debit transactions are $3 each.

** One monthly debit/ATM cash withdrawal is included; excess debit transactions are $3 each.

*0.005% interest rate for balance of $0-$999.99, 0.010% for balance of $1000+

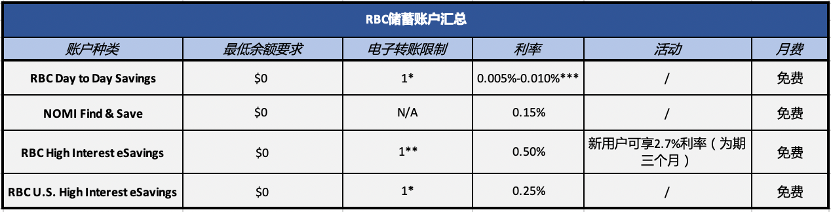

o 储蓄账户

RBC主要为客户提供四种类型的储蓄账户,即RBC Day to Day Savings、NOMI Find & Save、RBC高息电子储蓄、以及RBC美国高息电子储蓄;这四种选择都不需要每月付款。

*每月免费电子转账一笔,超过部分每笔$3

**每月免费电子转账/ATM提款一笔,超过部分每笔$5

***当余额为$0-$999.99时,利率为0.005%。当利率为$1000+时,利率为0.010%

o Credit Cards

RBC provides a selection of credit card categories such as travel, reward, cash back, low interest, student and business. The purchase rates of these cards range from as low as prime + 4.99% to as high as 20.50%, while the cash advance rates range from prime + 4.99% to 22.99%. Cards from different categories have different benefits and disadvantages. For example, for travel lovers, the RBC Avion Visa Infinite Privilege card holder has the benefit of getting 35,000 welcome points on approval and earning 1.25 RBC reward points for every dollar they spend; however, the card has a hefty annual fee of $399, which could be a burden for many people.

o 信用卡

RBC提供一系列的信用卡类别,如旅游卡、奖励卡、现金返还卡、低息卡、学生卡和商务卡。这些卡的购买利率从最低的优惠利率+4.99%到最高的20.50%不等,而现金预支利率从优惠利率+4.99%到22.99%不等。不同类别的卡有不同的好处和坏处。例如,对于旅游爱好者来说,RBC Avion Visa Infinite Privilege卡的持卡人的好处是在批准时可以获得35,000个欢迎积分,每消费一美元可以获得1.25个RBC奖励积分;但是,该卡有399美元的高额年费,这对许多人来说可能是一种负担。

Commercial Banking: Commercial banking is an indispensable part of RBC’s financial service. As of 2021, the commercial banking segment is accounted for 23% of RBC’s personal & commercial banking’s total revenue (RBC 2021 annual report). RBC offers a wide range of lending, leasing, deposit, investment, foreign exchange, cash management, auto-dealer financing, trade products, and services to small and medium-sized commercial businesses across Canada.

商业银行业务

商业银行是加拿大皇家银行金融服务中不可或缺的一部分。截至2021年,商业银行部分占RBC个人和商业银行总收入的23%(RBC 2021年年度报告)。RBC向加拿大各地的中小型商业企业提供广泛的贷款、租赁、存款、投资、外汇、现金管理、自动交易商融资、贸易产品和服务。

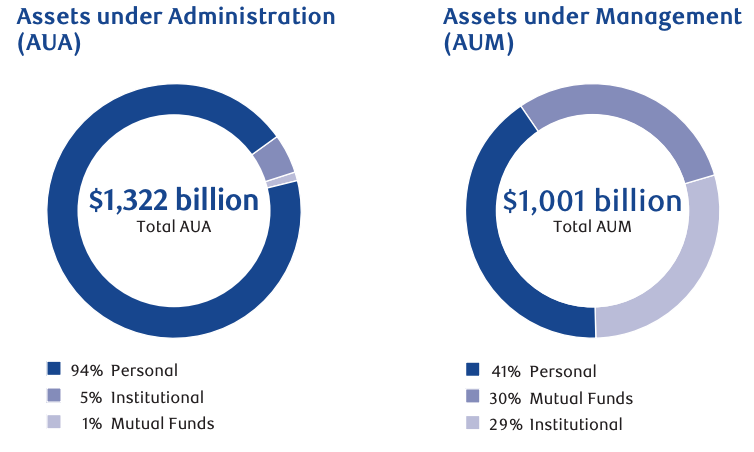

Wealth Management: RBC’s wealth management department generated $13.3 billion in the fiscal year 2021, while holding $1,322 billion worth of assets under AUA and $1,001 billion under AUA with the help of 5,500 client-facing advisors (RBC 2021 Annual Report). The bank offers services such as Canadian Wealth Management, U.S. Wealth Management, Global Asset Management, and International Wealth Management. This section is primarily focused on analysing the Canadian Wealth Management, the largest full-service wealth advisory in Canada as measured by AUA.

财富管理业务

RBC的财富管理部门在2021财年创造了133亿美元的收入,公司目前超过5500名投资顾问管理 着持有价值13220亿美元的AUM资产和10100亿美元的AUA资产(下图来源为RBC2021年度财务报告)。该银行提供加拿大财富管理、美国财富管理、全球资产管理和国际财富管理等服务。

Canadian Wealth Management: RBC provides investment management for individual investors and business owners. Individual investors can determine whether they want the hands-off (AUM) or hands-on (AUA) approach with their portfolio, whereas business owners can delegate RBC specialists to make investment decisions for them so they can focus on their businesses. CWM also deliver wealth-planning services including tax planning, estate planning, funding education and etc.

目前加拿大财富管理模块来看,该公司的AUA资产管理规模是五大行中最大的,主要为个人投资者和企业主提供投资管理。个人投资者可以决定他们选择AUM还是AUA,而企业主可以委托RBC的专家来做投资决定。除此外,该公司的财富管理团队服务内容包括财富规划服务,包括税务规划、遗产规划、资金教育等。

Pros and Cons List:

- Pros:

o Offers a variety of personal, business, and investment products and services

o Many physical locations across Canada

o Top-of-the-line financial management service

- Cons:

o Customer Service isn’t great according to customer reviews from multiple online sources

o Lower interest rates paid on savings account compared to competitors, especially for HNW individuals (e.g., RBC high interest eSavings 0.50%, TD ePremium Savings 0.60%)

o Outdated mobile investment platform

RBC优缺点对比

O优点:

1. 提供了多样化的个人业务,商业银行业务,以及投资类产品与服务。

2. 存款账户无需最低余额要求

3. 一流的财富管理服务

4. 大量分行遍布加拿大

O缺点:

1. 多家网络评分机构数据指出,该行客服质量有待提高。

2. 跟竞争对手相比,RBC存款账户的利息相对较低。以TD为例,该行的TD ePremium Savings Account提供0.600%的利率,而RBC与之相似的RBC High Interest eSavings Account却只提供0.500%的利率。

3. 手机端交易平台相对比较落后。