About the Candidate

The business comprises four segments: Commercial Banking (CMB), Global Banking (GB), Markets and Securities Services (MSS), and Wealth and Personal Banking (WPB). Individuals, SMEs, corporations, government and institutional clients, and private investors can all benefit from the company’s comprehensive variety of financial products and services, which include current and savings accounts, personal and auto loans, mortgages, credit and debit cards, wealth management, real estate and financial planning, cash management, international trade, treasury solutions, capital markets and advisory services, bilateral and syndicate lending, leveraged and acquisition finance, money market instruments, and other services.

加拿大汇丰银行业务主要包括四大板块:商业银行业务(CMB)、全球银行业务(GB)、市场与证券服务业务(MSS)、财富与个人银行业务(WPB)。个人、中小企业、企业、政府和机构客户,以及私人投资者都可以从公司全面多样的金融产品和服务中受益。这些产品和服务包括活期和储蓄账户、个人和汽车贷款、抵押贷款、信用卡和借记卡、财富管理、房地产和金融规划、现金管理、国际贸易、资金解决方案、资本市场和咨询服务、双边和银团贷款、杠杆和收购融资,货币市场工具和其他服务。

接下来将分别从四大板块来介绍加拿大汇丰银行业务,主要以2021年业务表现来做阐述说明。

Commercial Banking (CMB)

Commercial Banking provides banking products and services to corporate clients ranging from small businesses to large corporations with global operations.

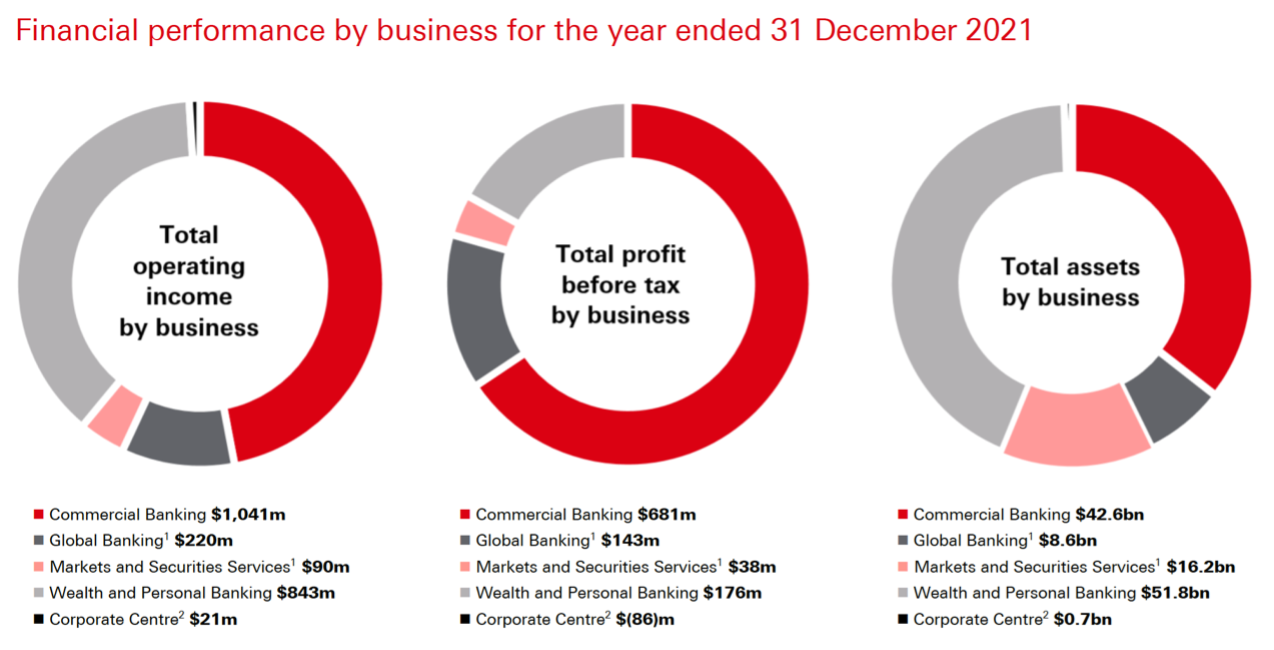

As for 2021, the total operating income for the CMB business was $1,041 million (see pie chart). Loans and acceptances increased by $3.5 billion and deposit balances increased by $2.1 billion. Non-interest income improved similarly as the number of bankers’ acceptances increased, as well as customer activity in foreign exchange, international and domestic payments and credit cards. In addition, a growing number of green finance tools are being developed, including five new sustainable finance products for commercial bank customers: Green Deposit, Sustainable Trade Finance, Green Revolving Credit Arrangement, Sustainable Linked Loan and Green Equipment Finance.

商业银行业务

商业银行业务为企业客户提供银行产品和服务,客户类型从小型企业到大型跨国公司全面覆盖。

截至2021年,商业银行业务营业总收入为10.41亿加元(见饼状图)。贷款和承兑票据增加35亿加元,存款余额增加21亿加元。随着银行承兑汇票数量的增加,以及客户在外汇、国际和国内支付以及信用卡方面活动的增加,非利息收入也同样增加。此外,越来越多的绿色金融工具持续在开发中,包括面向商业银行业务客户的五种新型可持续金融产品:绿色存款、可持续贸易融资、绿色循环信贷安排、可持续关联贷款和绿色设备融资。

Global Banking (GB)

Global Banking provides financial services and products to corporations, governments and institutions. These comprehensive products and solutions can be combined and customized, from primary equity and debt capital to global trade and receivables financing, to meet the specific goals of clients.

GB’s profit before income taxes for the full year 2021 was $143 million (see pie chart), an increase of $56 million or 64% compared to the prior year, due to improved forward-looking macroeconomic guidance and a favorable change in expected credit losses. What’s more, GB pursues its well-established strategy of providing tailored wholesale banking solutions, leveraging HSBC’s extensive distribution network to deliver products and solutions that meet the needs of its global customers and support them seek to return to growth and plan their transition to a net-zero carbon economy.

全球银行业务

全球银行业务为企业、政府和机构提供金融服务和产品。通过可以结合和制定的全面的产品和解决方案,从初级股权和债务资本到全球贸易和应收账款融资,都可以满足客户的特定需求。

在2021年,由于前瞻性宏观经济指导的改善和预期信贷损失的有利变化,全球银行业务的税前利润为1.43亿加元(见饼状图),比上年增加了5600万加元或增涨64%。此外,全球银行业务奉行其完善的战略,利用汇丰银行广泛的分销网络提供量身定制的解决方案,以满足其全球客户的需求,并支持他们寻求恢复增长和计划向净零碳经济转型。

Markets and Securities Services (MSS)

Markets and Securities Services enables corporate and institutional clients to access financial markets and liquidity, unlock investment opportunities, manage risk and trade seamlessly. This business segment brings together financing solutions, sales and trading, research, clearing and settlement, global and direct custody, and asset servicing.

Like Global Banking, MSS continues to pursue its well-established strategy of providing tailored solutions, leveraging HSBC’s extensive distribution network to deliver products and solutions to meet the needs of its customers around the world and support them seek to return to growth and plan their transition to a net-zero carbon economy.

市场及证券服务业务

市场与证券服务业务使企业和机构客户能够进入金融市场,释放投资机会,无缝管理风险和交易。这个业务部门集融资解决方案、销售和交易、研究、清算和结算、全球和直接托管以及资产服务于一体。

与全球银行业务一样,市场与证券服务业务继续奉行其完善的战略,利用汇丰银行广泛的分销网络提供量身定制的产品和解决方案,以满足其全球客户的需求,并支持他们寻求恢复增长和计划向净零碳经济转型。

Wealth and Personal banking (WPB)

Wealth and Personal Banking provides a full range of competitive banking products and services to help clients manage their finances, buy their homes, and save and invest for the future. It has a wide range of global investment products and other professional services.

As for 2021, WPB achieved record revenue and profit (before tax). The overall and international customer base has grown as WPB continues to invest in distribution channels and market-competitive products. Providing customers with more convenient banking services and improving the customer experience with digital enhancements such as mobile chat, opening digital accounts for international customers who have not yet arrived in Canada, and allowing customers to retrieve additional documents digitally at their convenience.

财富与个人银行业务

财富和个人银行业务提供全方位的有竞争力的银行产品和服务,帮助客户管理财务、购买房屋、未来的储蓄和投资。该业务部门拥有广泛的全球投资产品和其他专业服务。

在2021年,财富和个人银行业务实现了创纪录的收入和利润(税前)。随着业务继续投资于分销渠道和具有市场竞争力的产品,整体和国际客户基础不断增长。公司为客户提供更便捷的银行服务,并通过移动聊天、为尚未抵达加拿大的国际客户开设数字账户、允许客户在方便的时候以数字方式检索其他文件等数字增强功能来改善客户体验。

Pros and Cons List:

- Pros:

1. Minimum deposit of $1 in a checking or savings account

2. Monthly checking account fees can be easily waived

3. Minimum balance of $1 to earn Annual Percentage Yield (APY)

4. No minimum balance requirement or monthly fees for daily savings accounts

5. Bonuses for new customers and referrals

6. International banking options

- Cons:

1. Low Annual Percentage Yield (APY) on interest-bearing checking accounts

2. Overdraft protection may cost more than insufficient funds

3. HSBC and HSBC InvestDirect are not linked online

4. The number of ATMs is not available online

利弊清单:

——优点:

1. 支票或储蓄账户的最低存款额为1加元

2. 可轻松免除支票账户月费

3. 最低余额为1加元,即可获得年度百分比收益率。

4. 日常储蓄账户没有最低余额要求或月费

5. 新客户和推荐人可获得红利

6. 国际银行业务选择

——缺点:

1. 有息支票账户年利率低

2. 透支保护的成本可能超过不足的资金

3. HSBC与HSBC InvestDirect在网上没有联系

4. ATM机数量在网上无法查询