About the Candidate

Canadian Retail: With 43,707 employees and 1,060 branches in Canada, TD Canadian Retail’s main business lines are Personal Banking, Business Banking, and Wealth Management.

- Competitive Advantage: TD is ranked #1 or #2 in market share for most retail banking products, and it is ranked as the #1 Canadian banking app as well as #1 in average digital reach in Canada, according to Comscore. TD has an outstanding asset management department too, as it is the largest institutional money manager in Canada.

- Personal Banking: Services provided within this category include personal deposits, credit cards & payments, real estate secured lending, consumer lending, and auto finance. The main focus of this segment is on personal deposits and credit cards & payments.

加拿大境内零售业务:TD在加拿大拥有 43,707 名员工和 1,060 家银行网点。和多数综合性银行一样,其主要业务包括个人银行业务、商业银行业务和财富管理业务。

竞争优势:

根据 Comscore 的数据,TD 在大多数零售银行产品的市场份额中排名第一或第二,并且在加拿大的银行APP与平均数据覆盖范围中都排名第一。 TD也拥有杰出的资产管理业务,因为它有着加拿大最大的机构投资管理部门。

让我们先来看看TD的个人和商业银行业务。

划重点:个人银行业务

个人银行业务提供的服务包括个人存款、信用卡和支付、房地产担保贷款、消费贷款和汽车金融。 该部分的主要关注点是个人存款和信用卡与支付。

o Chequing Accounts

· 支票账户

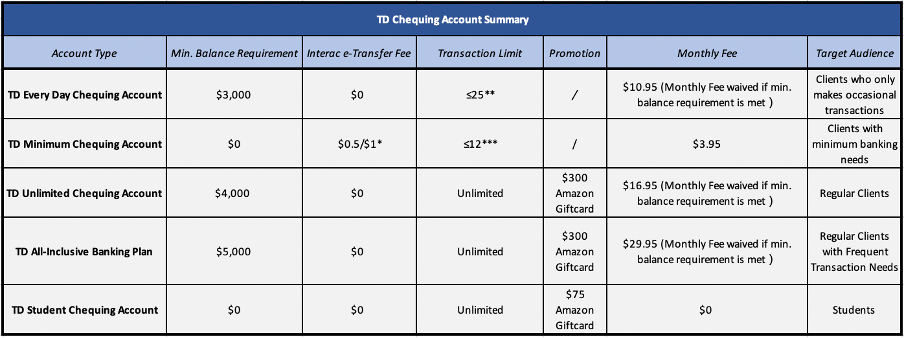

TD的五种支票账户类型如下:

*$0.5 fee for transfer under $100, $1 fee for transfer above $100.

**Limited to 25 transactions per month, $1.25 each thereafter.

***Limited to 12 transactions per month, $1.25 each thereafter.

o Savings Account

· 储蓄账户

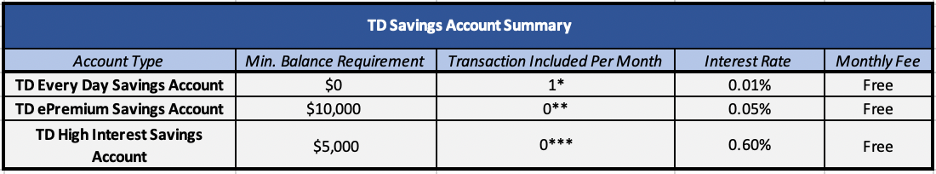

TD一共为客户提供三种储蓄账户:

*One monthly debit is included; excess debit transactions are $3 each.

**Transaction fee is $5 each.

***Transaction fee is $5 each; fee waived with minimum balance of $25,000+.

o Credit Cards

TD offers an extensive range of credit cards that apply to the clientele bases which are personal, business, and students. There are also multiple features a client can choose from, including cash back, Aeroplan points, TD travel rewards, no annual fee, low rate, and U.S. dollar. For example, if an individual or a student is looking for a cash back credit card with no annual fee, they should consider the TD Cash Back Visa Card, which requires no annual fee and allows the cardholder to earn cash back dollars to pay down their account balance. As for business owners, if they are looking for a low-rate credit card, for instance, the TD Business Select Rate Visa Card might be a good option for them, as it only requires an interest rate of 11.99% for both purchases and cash advances.

· 信用卡

TD 提供多种多样的信用卡来满足个人、企业和学生等客户群的需求。 这些信用卡还有多种特色供客户选择,包括现金返还、Aeroplan 积分、TD 旅行奖励、零年费、低利率和美元信用卡。 这里举个例子,如果个人客户或学生正在寻找零年费的现金返还信用卡,他们应考虑使用 TD Cash Back Visa 卡,该卡无需年费,并且允许持卡人赚取返还金额来支付信用卡额度。对于企业主而言,如果他们正在寻找低利率信用卡,TD Business Select Rate Visa Card 可能是一个不错的选择,因为它在支付或预借现金时只需收取11.99%的利率。

- Business Banking: TD’s Business Banking offers a broad selection of customized products and services to help businesses grow such as business banking accounts, U.S. banking services, along with investing, financing, cash management, and etc. The main focus of this segment is on business banking accounts and U.S. banking services.

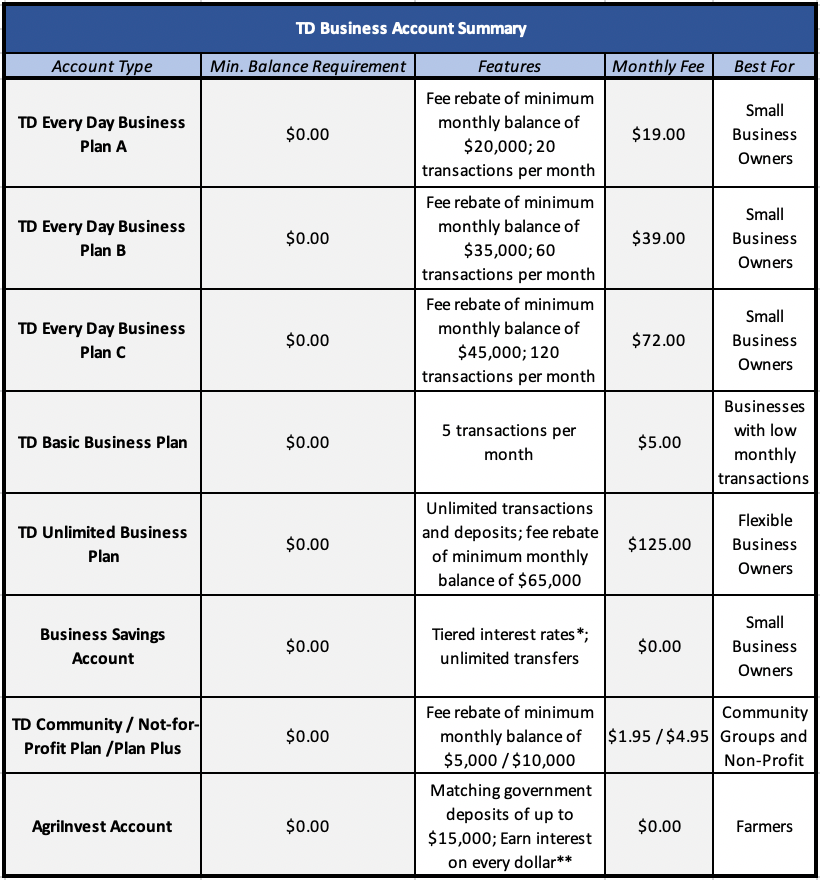

o Business Banking Accounts

商业银行业务

TD的商业银行业务提供广泛的定制产品和服务以帮助企业发展,例如商业银行账户、美国银行服务以及投资、融资、现金管理等。该部分主要介绍的是TD的商业银行账户和美国银行服务。

· 企业账号汇总

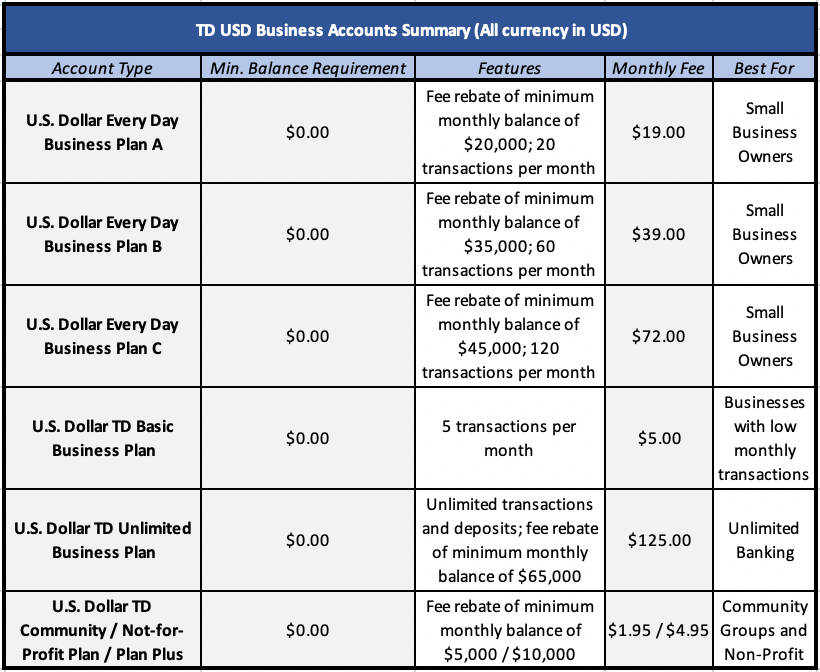

o USD Business Banking Services:

Unlike RBC whose main focus is on the Canadian market, TD offers an extensive range of products and services for the U.S market too, especially for business banking. In the fiscal year ended on Dec 31, 2021, TD’s U.S. retail segment generated a revenue of $10.758 billion Canadian dollars, out of which $3.81 billion was contributed by the business banking department (TD 2021 Annual Report), which is almost 5 times as much as the revenue of RBC’s Caribbean & U.S. banking combined (RBC’s revenue was $776 million according to their 2021 annual report). Below is a list of TD’S U.S. business banking accounts:

· 美元商业银行业务

与主要业务在加拿大市场的 RBC 不同,TD 也为美国市场提供广泛的产品和服务,尤其是商业银行业务。 在截至 2021 年 12 月 31 日的财年中,TD美国零售部门的收入为 107.58 亿加元,其中商业银行部门贡献了 38.1 亿美元(TD 2021 年报),几乎是RBC加勒比地区和美国零售部门总收入的五倍(根据其 2021 年年度报告,RBC 2021年年收入为 7.76 亿美元)。 以下是TD美元企业账户列表:

- Wealth Management: TD primarily offers two investment platforms for its recreational investors, which are TD Easy Trade and Direct Investing. On top of that, it also gives clients the option to seek for personalized wealth advice as well as personal investing guidance from their financial advisors.

o TD Easy Trade: This is a platform designated for new investors who are looking to purchase Canadian and U.S. stocks and ETFs conveniently from a mobile app. TD charges no commission fee on the first 50 stock purchases of the year and no commission fee on ETFs trading whatsoever. Furthermore, they charge no monthly or quarterly account maintenance fee.

o Direct Investing: This is a platform designated for experienced traders who enjoy a feature-rich DIY trading experience. It offers a range of accounts that suit different client’s preference, including cash accounts, Self-Directed Tax-Free Savings Account (TFSA), Registered Retirement Savings Plan (RSP), margin accounts, Registered Education Savings Plan (RESP), Self-Directed Retirement Income Fund (RIF), Self-Directed Locked-in Retirement Accounts (LIRA), Life Income Funds (LIF), and Self-Directed Registered Disabilities Savings Plan (RDSP). It also provides its clients with powerful trading tools such as WebBroker, TD app, Advanced Dashboard, and thinkorswim.

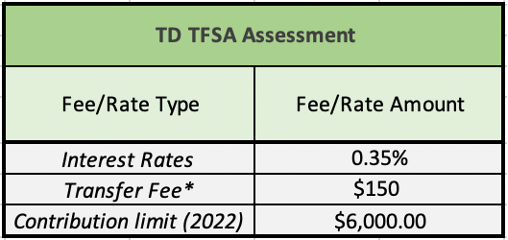

o Tax-Free Savings Account (TFSA): TD offers four types of TFSA including TD Canada Trust TFSA, Self-Directed TFSA, TD GICs and Term Deposits, and TD Mutual Funds TFSA. The basic assessment of TD’s TFSA is shown below.

财富管理业务

TD主要为其散户提供两个投资平台,即TD Easy Trade和Direct Investing。除此之外,道明的财务顾问还可以为其客户提供个性化财富建议以及个人投资指导。

· TD Easy Trade:

这是一个专为新投资者打造的手机端购买加拿大和美国股票以及ETF的平台,因此使用起来非常方便。TD对投资者每年的前五十笔交易不会收取佣金,ETF交易则完全不会收取中间费。此外,他们也不收取每月或每季度的账户维护费。

· TD Direct Investing(自管投资):

这是一个专为经验丰富的投资者设立的平台。它提供了一系列适合不同客户偏好的账户,包括现金账户、自管免税储蓄账户(TFSA)、注册退休储蓄计划(RSP)、保证金账户、注册教育储蓄计划(RESP)、自管退休收入基金 (RIF)、自管锁定退休账户 (LIRA)、终身收入基金 (LIF) 和自管注册残疾人储蓄计划 (RDSP)。 它还为客户提供了多样化的交易工具,例如网上经纪服务、TD app、高级交易仪表板和thinkorswim。

· 免税储蓄账户 (TFSA):

TD为其客户提供四种免税储蓄账户,包括TD互惠基金TFSA、TD加拿大信托TFSA、TD GIC和固定存款以及自管免税储蓄账户(TFSA)。

o GIC (担保投资证明):道明提供三种可兑现或不可兑现的担保投资证明,包括TD加拿大银行及公用事业GIC、TD加拿大银行GIC和TD美国 500大GIC。

o 互惠基金 / TD安富投资组合:这是 TD 的特色项目之一。 道明为其具有不同风险偏好的客户提供了六种投资组合选项。 这些选项包括道明安富保守收益投资组合、道明安富平衡收益投资组合、道明安富均衡投资组合、道明安富平衡增值投资组合、道明安富增值投资组合和道明安富积极成长型投资组合。

o Guaranteed Investment Certificate (GIC): TD offers three types of cashable or non-cashable GICs including TD Canadian Banking & Utilities GIC, TD Canadian Banks GIC, and TD U.S. Top 500 GIC.

o Mutual Funds / TD Comfort Portfolios: This is one of TD’s specialty. TD offers six portfolio options for its clients with different risk preferences. These options are TD Comfort Conservative Income Portfolio, TD Comfort Balanced Income Portfolio, TD Comfort Balanced Portfolio, TD Comfort Balanced Growth Portfolio, TD Comfort Growth Portfolio, and TD Comfort Aggressive Growth Portfolio.

- TD Pros and Cons:

o Pros:

§ Good variety of personal banking, business banking, and investment products and services

§ Competitive savings account interest rates

§ Many business banking options for those that have businesses in the U.S.

§ Diverse portfolios for investors to choose from

§ 24/7 customer service on the phone

o Cons:

§ Business banking accounts generally charge a higher monthly fee than its competitors

§ Charges a relatively high transfer fee for its TFSA investments

§ For direct investing, slightly higher commissions for stocks, ETFs, and options trading compared to other banks

TD优缺点对比

· 优点:

1. 种类繁多的个人银行业务、商业银行业务以及投资产品和服务

2. 有一定竞争力的储蓄账户利率

3. 跟竞争对手相比,为在美国开展业务的客户提供更多的商业银行业务选项

4. 多样化的投资组合供客户挑选

5. 24/7 电话端客户服务

· 缺点:

1. 商业银行账户通常比其竞争对手收取更高的月费

2. 对其 TFSA 投资收取相对较高的过户费

3. 从自管投资的角度来说,TD与RBC相比,股票、ETF 和期权交易的佣金略高